If you’re just discovering the DORA and haven’t yet launched your compliance incentives, start with Memcyco’s DORA compliance guide that’s better suited for those just starting the journey. If you’ve already launched your DORA compliance incentives, this DORA readiness assesment will provide detailed benchmarks to ensure you’re on the right track.

To download the full self-assesment benchmarks – covering key DORA pillars, the action plan you should be following, and pitfalls to avoid – scroll to the bottom.

Let’s start by recapping a few DORA-related facts that you should already be pretty much familair with.

Who Neets to Comply with the DORA?

If you’ve already read the guide mentioned in the intro, you’ll already know that the Digital Operational Resilience Act (The DORA) is an EU regulation designed to standardize and strengthen financial institutions’ resilience against ICT-related incidents. It applies to banks, insurance firms, investment companies, and third-party ICT providers servicing the financial sector.

| Financial Entities | ICT Service Providers |

|---|---|

| Payment and credit institutions | Cloud providers |

| Electronic money institutions | Network security companies |

| Investment firms | IT consulting firms |

| Insurance companies | Managed IT service providers |

| Trade repositories | Help desk service providers |

What’s key about the DORA is that, despite consolidates pre-existing optional guidelines and frameworks, it isn’t optional. Rather, it’s legally enforceable with non-compliance costing up to 2% of revenue. But that’s not happening, right?

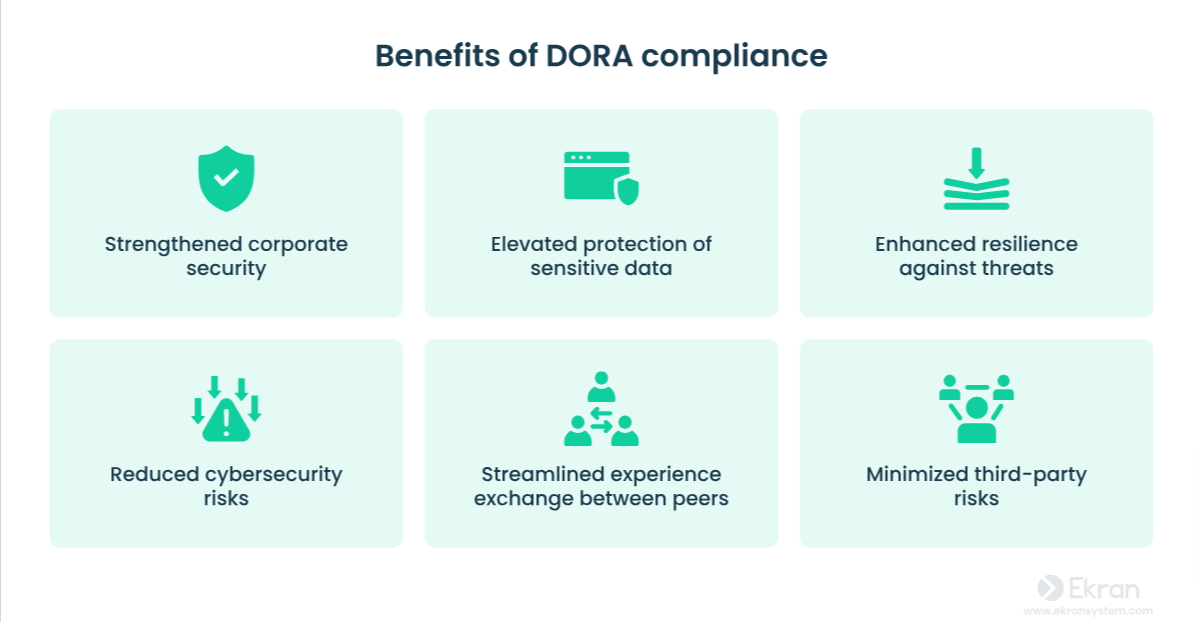

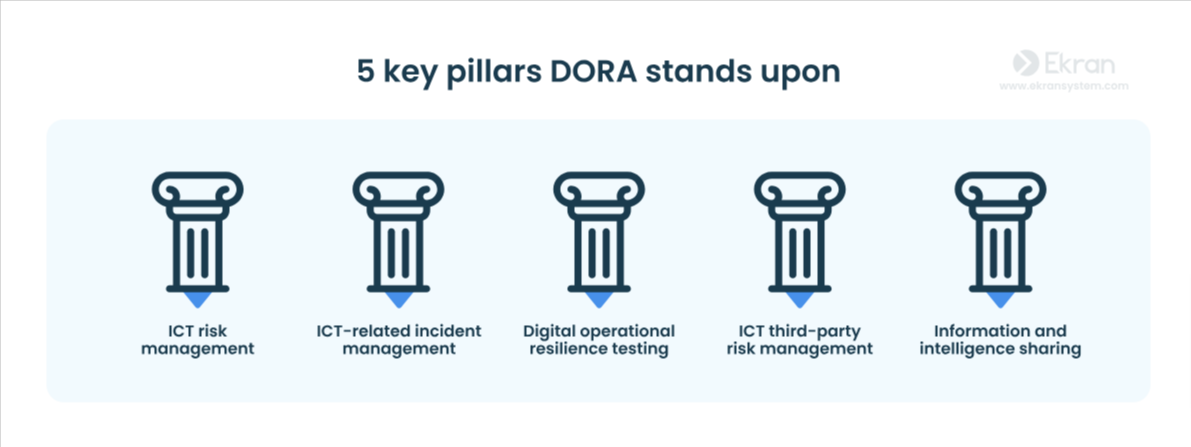

What Are the Key DORA Compliance Areas?

✔ ICT Risk Management – Establishing robust risk frameworks

✔ Incident Reporting – Standardizing reporting procedures and response timelines

✔ Resilience Testing – Conducting regular penetration testing

✔ Third-Party Risk Oversight – Ensuring ICT providers meet DORA standards

Now, let’s break down the first three critical compliance steps.

Source

Source

The DORA Compliance Readiness Assesment

Let’s start with the first three steps you may already be taking. Along the way, we’ll flag key things to factor for that may not be immediately obvious.

To get the full DORA readiness assesment – with extra guidance pitfalls to avoid – click the download banner below.

1. Establishing a Strong ICT Risk Management Framework

- Develop a formal risk management framework with clear policies and procedures.

⚠️ It’s worth emphasizing that a policy on paper isn’t enough – enterprises must prove risk management is actively enforced through audits, testing, and real-time monitoring. - Assign governance responsibilities at the senior management level.

⚠️ Here, board involvement will be critical – many compliance failures stem from a lack of senior oversight, so try to advocate for DORA compliance as a C-level priority. - Implement a continuous improvement cycle based on audits and incidents.

⚠️ Expect to encounter third-party dependencies – financial entities must ensure that outsourced ICT providers also follow the same risk management framework.

2. Establishing Incident Detection and Reporting Protocols

- Implement standardized procedures for identifying and reporting ICT incidents.

⚠️ “Significant incidents” must be clearly defined – not every cybersecurity issue requires regulatory reporting, but failing to report serious ones can result in penalties. Ensure your anti-phishing tools are able to quickly provide comprehensive reports. - Define incident reporting timelines and ensure compliance with regulatory authorities.

⚠️ Time is a factor – regulators expect swift reporting. Ensure an incident response plan is in place and frequently tested. - Set up real-time monitoring for proactive risk mitigation.

⚠️ Data quality matters – vague or inconsistent reports increase regulatory scrutiny. Standardized reporting formats should be clear, concise, and detailed.

3. Digital Resilience Testing and Continuous Monitoring

- Conduct penetration testing, vulnerability scans, and scenario-based stress tests.

⚠️ Testing isn’t one-size-fits-all – not every organization has the same risk profile. Ensure testing is tailored to the company’s infrastructure and threat exposure. - Ensure annual testing for all critical ICT systems.

⚠️ Avoid “check-the-box” compliance – regular testing should be more than a formality. It should actively improve security posture. - Use test results to prioritize remediation efforts and strengthen resilience.

⚠️ Think carefully about third-party testers vs. internal testing – The DORA encourages using external penetration testers for unbiased evaluations.

DORA Myths Debunked: Fact vs. Fiction

Ok. Time for some DORA myth busting to dispel any assumptions you could be making.

Myth 1: “The DORA doesn’t apply to financial institutions based outside the EU.”

Reality: Wrong. Even financial institutions located outside the EU must comply if they provide services to EU-based clients or operate within the EU financial ecosystem.

Myth 2: “The DORA is just a recommendation, not a legal requirement.”

Reality: The DORA is now legally binding across the EU financial sector.

Myth 3: “If we follow existing cybersecurity frameworks, we’re already compliant.”

Reality: While The DORA integrates pre-existing guidelines, it has stricter enforcement mechanisms, so adherence to related cybersecurity frameworks isn’t enough.

Myth 4: “DORA compliance only applies to banks.”

Reality: The regulation affects all financial entities, including insurance firms, investment companies, and critical third-party ICT providers.

Myth 5: “The DORA only focuses on cybersecurity.”

Reality: While cybersecurity is a core component, The DORA covers broader operational resilience, including third-party risk management, incident response, and business continuity planning.

Myth 6: “Once we achieve compliance, we’re done.”

Reality: DORA requires ongoing compliance, including regular audits, testing, and continuous monitoring to stay ahead of evolving threats.

How Memcyco Can Fast Track Your DORA Compliance

There’s no getting away from the fact that, for scam-targeted industires and enterprises, meeting DORA’s strict requirements will require a fundamental shift to proactive, real-time visibility of phishing-related scams as they unfold.

Besides providing this visibility, Memcyco strengthens financial institutions’ DORA compliance readiness by addressing key regulatory challenges:

✔ Phishing Attack Prevention – dentifies and mitigates impersonation scams and fraudulent websites by detecting phishing attempts before they reach customers.

✔ Incident Detection & Reporting – Provides real-time forensic insights into phishing-related incidents, attack devices, and even individual victims, supporting faster response and regulatory reporting.

✔ Advanced Device Identification – Establishes robust user-device pairings to detect anomalies like credential stuffing, brute-force attacks, and fraudulent device behavior.

✔ Third-Party Risk Management – integrates with third-party fraud risk engines and provides APIs for authentication and transaction monitoring, ensuring financial institutions maintain oversight over vendor ecosystems.

✔ Resilience Testing & Continuous Improvement – Uses AI-driven threat detection and adaptive security rules to help financial institutions continuously improve digital fraud defenses in line with evolving threats.

With Memcyco’s real-time digital risk protection, financial institutions can meet DORA’s compliance requirements faster while strengthening their resilience against phishing, impersonation, and ATO fraud—without adding user friction. Get a Memcyco demo to learn more.

![A graphic featuring the text "DORA Compliance Readiness Assessment [Downloadable]" beside a computer monitor with a download icon and a shield labeled "DORA Compliance Readiness.](/wp-content/uploads/2025/02/DORA-Compliance-Readiness-Assessment_1200x630-1024x538.png)