Credit Card Scams

Real-time card fraud detection, protection and response

Slash the cost and revenue impact of card theft and payments fraud by proactively protecting customers, no matter how many digital impersonation scams they fall for.

Credit card scam attack anatomy

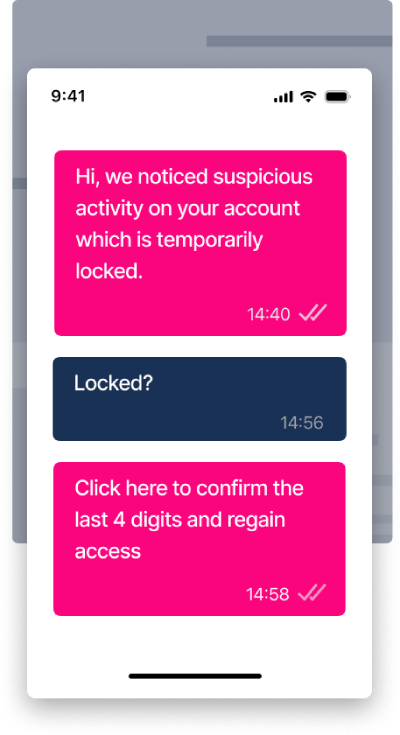

PHASE 1

The bait

Amateur fraudsters are now duping even the most prudent customers, with AI-assited scams tailored to individual vicims.

What if you could

Get visibility of credit card scams before customers

- Get visibility of potential credit card scams, before malicious messages reach customers

- Save money on buying and cross-checking lists of stolen card data, to check for impacted customers

- Reveal attack data you can use to trace perpetrators

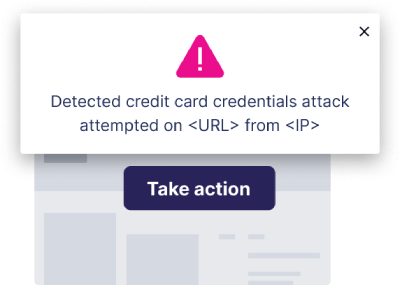

PHASE 2

The trap

Inexpensive, ready-made phish kits help card thieves with zero technical ability create digital content that impersonates your brand immaculately.

What if you could

Stop customers falling for credit card scams in the first place

- Reduce reliance on low impact scam awareness customer education

- Spend less time on the phone with defrauded customers, investigating incidents

- Protect Digital Trust, credibility and compliance

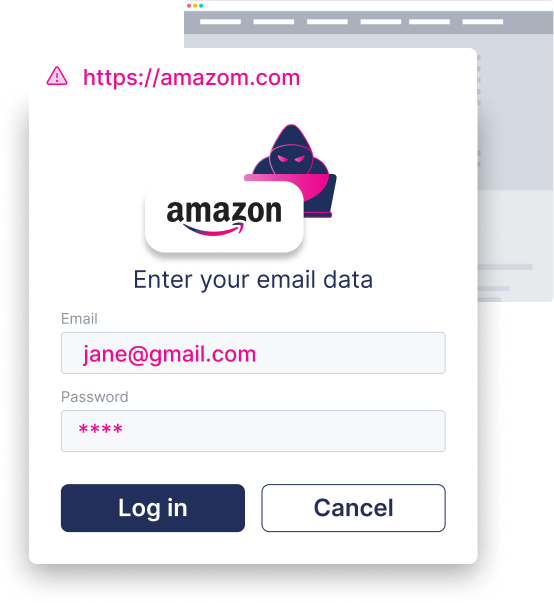

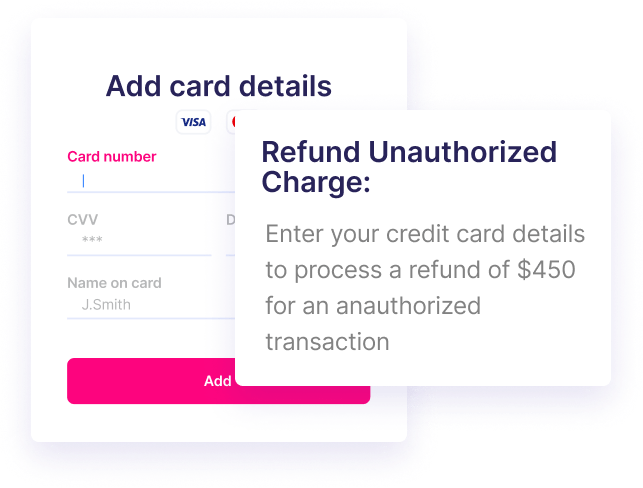

PHASE 3

Card data harvesting

Credit card scams are now so convincing, the usual signs you warn customers to look out for, are less and less present

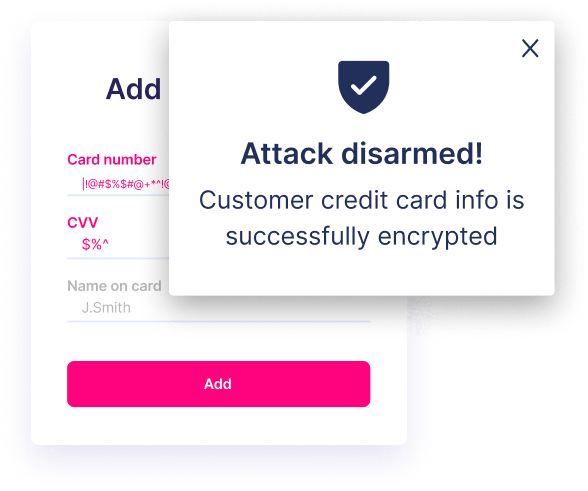

What if you could

Auto-disarm fraudsters that try to steal card data

- Keep card data safe, even if customers fall for digital impersonation scams

- Save money on buying and cross-checking lists of stolen card data, to check for impacted customers

- Reveal attack data you can use to trace perpetrators

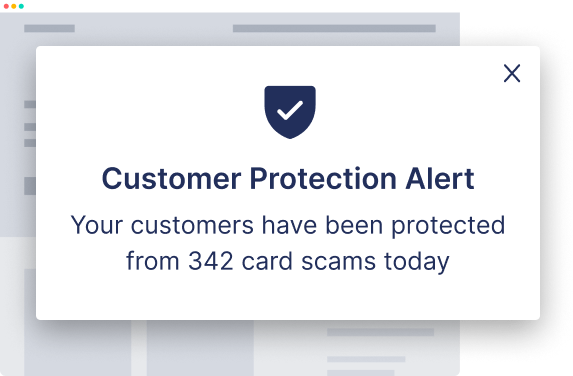

PHASE 4

Credit card fraud

While some fraudsters defraud customers, others sell their card data to others who defraud customers later. Memcyco has an answer for both.

What if you could

Reinforce Digital Trust, reduce churn and protect credibility

- Keep customer assets protected, even after credit card scams have been neutralized

- Spend less money on stolen card lists to cross reference, to identify impacted accounts

- Get notified of every single victim identity

Like any digital risk protection worth the investment, memcyco uses AI

What other solutions lack are real-time nano defenders

That’s how Memcyco does smarter things, instead of just doing the same things smarter.

WITH MEMCYCO

Detect earlier

before phishing messages are sent to customer devices

Protect instantly

the moment customers fall for credit card scam

Defend longer

after the attack is over, and malicious site is removed – but stolen card data is still available for sale on the darknet

WITHOUT MEMCYCO

Accumulate risk

detect credit card scam once they become full-fledged attacks

Expose customers

relying on them to know when they’re being scammed

Leave them exposed

to credit card scams risk long after fake-site takedown

Crush credit card scams earlier, and keep them crushed longer

with Memcyco’s real-time, multi-phase credit card scams protection

Discover how Memcyco detects card scams pre-emptively, keeping you and customers proactively protected, even if card data was stolen.

Protect, retain, save

Cut credit card theft by at least

50%

Achieve MTTD of

Zero

Reduce expenses by

$Millions

Discover more reasons why global teams use Memcyco

Already crushing credit card scams? Solve more

Higher education IP theft

Prevent theft of academic research and other intellectual property

Discover

Discover

Discover

Discover

Discover

Discover

GET A DEMO

Discover how Memcyco saves global businesses millions

Get a Memcyco demo and find out how Memcyco’s real-time nano defender technology is saving global enterprises millions in credit card scams incident handling and remediation costs.

Frequently asked questions

What are credit card scams and how do they work using digital impersonation?

Credit card scams involve fraudulent activities where scammers use deceitful methods to steal credit card information and commit unauthorized transactions. One common method is digital impersonation, where attackers create fake websites and other digital content that closely mimic legitimate businesses. These sites trick users into entering their credit card details, which are then stolen by the fraudsters. Additionally, attackers may send phishing emails or SMS messages that direct victims to these fake websites. Advanced digital impersonation protection solutions can help identify and neutralize these threats by alerting businesses the moment digital impersonation attacks start, while preventing users who click malicious links from exposing sensitive information.

Which industries are impacted by credit card scams and how?

Credit card scams affect a wide range of industries, including retail, finance, travel and hospitality. In retail, scams can lead to significant financial losses from chargebacks and fraud investigations. The finance industry faces risks such as unauthorized transactions and account takeovers, which can damage customer trust. In the travel and hospitality sector, fraudulent bookings, that lead to card theft and payment fraud, are on the rise. Each industry must implement tailored security strategies to mitigate these risks.

How do credit card scams impact a business's revenue and reputation?

Credit card scams can cause significant financial losses due to chargebacks, fines, and legal fees, while also damaging a company’s reputation. This loss of customer trust can lead to decreased customer retention and overall revenue. Proactive measures are essential to safeguard both financial health and brand integrity.

What proactive measures can businesses take to prevent credit card scams?

Businesses can implement multi-layered security solutions, such as secure payment gateways, encryption, and real-time fraud detection systems. Utilizing advanced digital impersonation protection, and proactive threat detection, can secure transactions and customer data, helping businesses stay ahead of potential threats.

How can businesses ensure the security of their online transactions?

Securing online transactions involves using SSL encryption, implementing tokenization, and regularly updating security protocols. Advanced website protection services ensure secure online transactions by continuously monitoring and mitigating potential threats.

What steps should a business take if a credit card scam is suspected?

Immediate actions include contacting financial institutions, notifying affected customers, and conducting a thorough investigation. Incident response teams can assist in analyzing breaches, mitigating damage, and preventing future incidents.

How do advanced security solutions help businesses protect against credit card scams?

Advanced security solutions offer real-time digital impersonation protection, proactive threat detection, and automated incident response. These solutions help businesses safeguard their revenue, reputation, and customer trust by helping identify and neutralizing threats faster, before they cause harm.

What technologies are essential for preventing credit card fraud in businesses?

Essential technologies include AI-driven fraud detection systems, secure authentication methods, encryption, and real-time monitoring. Leveraging cutting-edge technology provides comprehensive protection against credit card fraud and other cyber threats.

How can businesses minimize the legal risks associated with credit card fraud?

Ensuring compliance with data protection regulations like GDPR and PCI DSS is crucial. Regular security audits and adherence to industry standards can help minimize legal risks. Compliance solutions ensure your business meets all necessary regulatory requirements.

Why is real-time threat detection important for businesses?

Real-time threat detection allows businesses to identify and respond to fraud attempts immediately, reducing potential damage. Real-time monitoring solutions provide instant alerts and rapid response capabilities to protect businesses from evolving threats.

How can threat intelligence services benefit your business?

Threat intelligence services provide actionable insights into emerging threats, helping businesses stay ahead of cybercriminals. By continuously monitoring the threat landscape, businesses are protected against the latest fraud tactics and vulnerabilities.