If you recently took a relaxing European vacation and flew Air Europa, check your credit card statement. They are the latest victim of a malicious hack exposing customer credit card numbers, expiration dates, and even the associated stored CCV codes—which contradicts Payment Card Industry Data Security Standard (PCI DSS) regulations.

In our digital era, where online payments are integral to our lives, the threat of data breaches revealing protected payment card information is more ominous than ever. Data breaches cost businesses $4.35 million on average per incident in 2022, highlighting the urgent need for strong security measures.

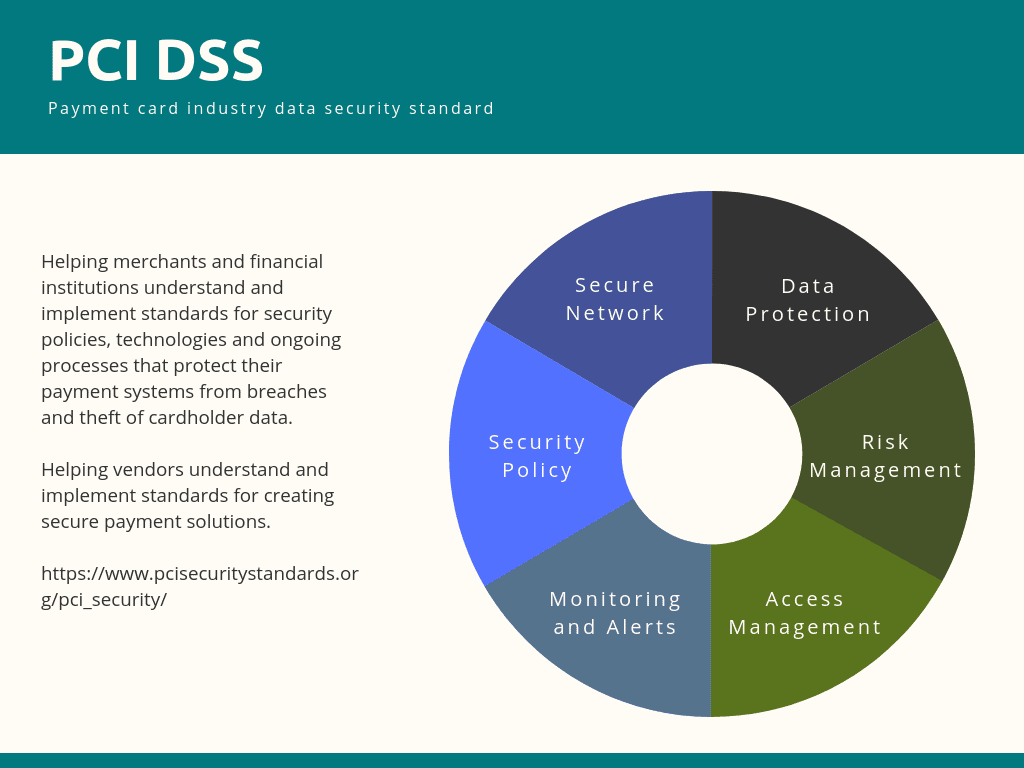

That’s where PCI DSS comes in. When correctly followed, PCI DSS plays a critical role in protecting card information from cyber threats and compliance. PCI DSS assures users that their data and finances are safe with your organization. But how can organizations comply with PCI DSS?

What is PCI DSS compliance?

Payment Card Industry Data Security Standards are security regulations designed to ensure that organizations that accept, process, store, or transmit payment card information maintain a compliant security environment.

It was established in 2006 by major credit card companies and encompasses various aspects of information security, including network architecture, software design, access controls, and monitoring. PCI DSS regulatory compliance applies to all entities involved in payment card transactions, including merchants, payment processors, financial institutions, and service providers.

PCI DSS compliance is indispensable for businesses of all sizes involved in international transactions. Any business handling Personally Identifiable Information (PII) data from payment cards must adhere to PCI DSS regulations.

What are the risks of non-compliance with PCI DSS?

Non-compliance with PCI DSS standards exposes a company to potential risks of cyberattacks and data breaches, as seen in the Air Europa cyber security incident. These incidents can result in critical data loss, substantial financial losses, damage to reputation, and potential legal liabilities.

The financial impact can vary based on the incident type, causing direct and indirect costs that affect the company over an extended period. Legal obligations bind the victimized company and may need to pay restitution to affected customers.

Payment card companies can impose fines until the company fulfills the requirements. Businesses may also face lawsuits as a consequence.

Non-Compliance Case Study: The 2007 TJX Breach

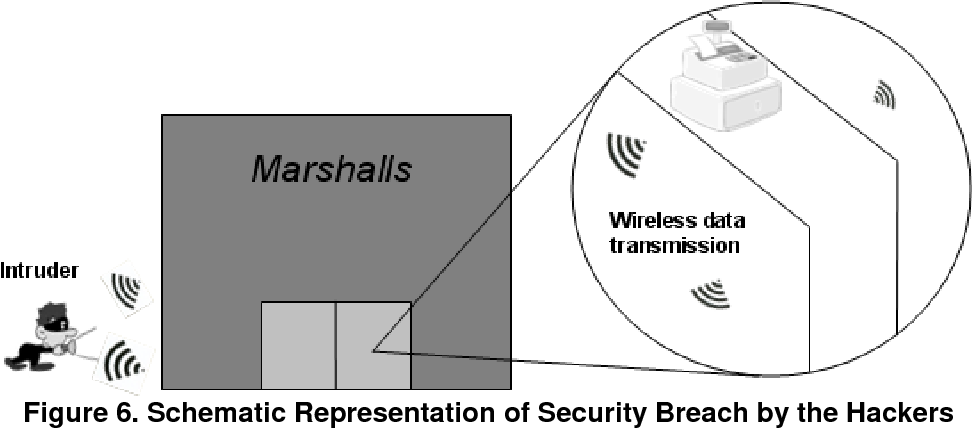

TJX Companies, the corporate entity behind retail giants TJ Maxx, Marshalls, and HomeGoods, experienced a massive data breach in 2007, revealing the payment card details of more than 45 million customers. This breach was linked to an undetected network vulnerability that persisted for several months.

TJX Companies had to pay $256 million to payment card companies as fines, including $41 million to Visa and $24 million to MasterCard. Moreover, they faced numerous lawsuits from affected customers and businesses seeking damages for financial losses, identity theft, and emotional distress.

Court documents following the breach noted that TJX fell short of meeting nine of the twelve PCI DSS requirements. The main factors of the incident were:

- An incorrectly configured wireless network.

- A failure in segmenting networks handling cardholder data from the rest of the TJX network.

- The storage of prohibited data.

The TJX Companies data breach is among the largest and most expensive in history, and a stark reminder of the critical significance of PCI DSS compliance.

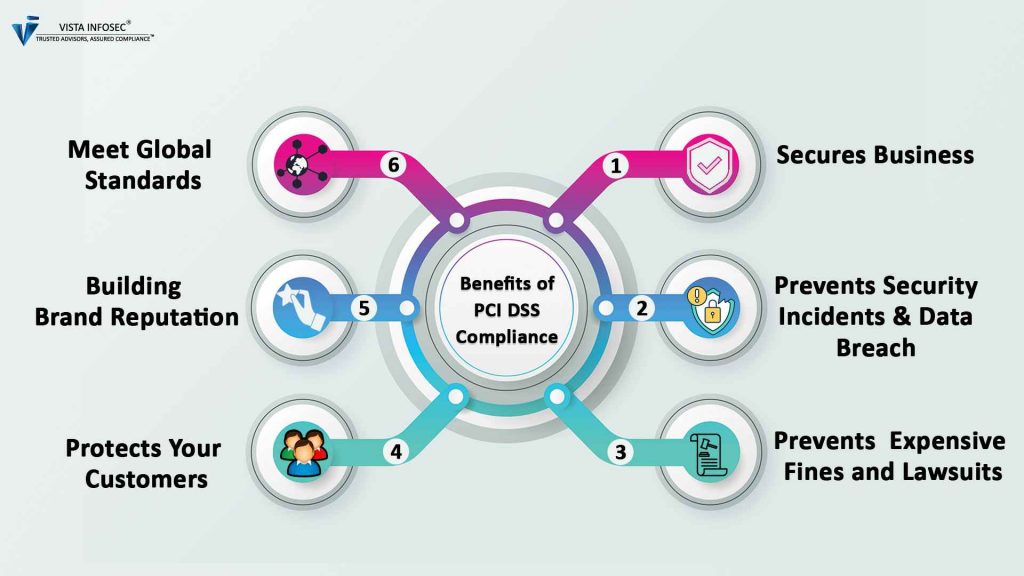

What are the benefits of PCI DSS Compliance?

PCI DSS compliance is not only a guideline that a business must follow; it’s a strategic investment with many significant benefits. These include:

- Enhanced Data Security – Achieving PCI DSS compliance is critical in ensuring data security. It’s the primary benefit that organizations can expect to attain by safeguarding sensitive payment card information effectively.

- Unrestricted Access to Payment Networks – Companies must adhere to PCI DSS standards to avoid being barred from processing payments online. Compliance is essential for maintaining access to payment card networks.

- Improved Brand Reputation – Consumers favor businesses that prioritize data security. By meeting PCI DSS requirements, companies showcase their dedication to protecting customer data, bolstering their reputation.

- Competitive Edge – PCI DSS compliance grants businesses a significant competitive advantage in industries where data sensitivity is paramount. Demonstrating a commitment to data protection can attract new customers and partners.

- Business Continuity Assurance – Compliance with PCI DSS helps prevent data breaches, crucial for sustaining uninterrupted business operations and ensuring long-term viability.

What are the PCI DSS Compliance’s goals and requirements?

PCI DSS compliance operates on six core goals, each with two specific requirements to fortify payment card data security.

Here’s a brief overview of the six core goals:

1. Build and Maintain a Secure Network and Systems

This goal establishes a robust foundation by ensuring a secure network and system infrastructure. Requirements include:

- Installing and maintaining a firewall.

- Using unique IDs for system access.

- Protecting stored data.

2. Protect Cardholder Data

This goal mandates the protection of cardholder data through encryption, secure transmission, and strict access controls. Businesses need to work cautiously with sensitive data, minimizing the exposure.

3. Maintain a Vulnerability Management Program

Ensure system security by consistently scanning and fixing vulnerabilities. Follow secure coding practices to minimize software vulnerabilities during development. Implement robust password policies, emphasizing length, complexity, and regular changes.

Download Your Free PCI DSS Compliance Checklist for 2024 [XLS]

4. Establish Strong Access Control Measures

Access to cardholder data should be tightly controlled, with unique user IDs, strong password requirements, and mandatory multi-factor authentication. Physical access is further restricted using key locks and badges.

5. Regularly Monitor and Test Networks

The objective here is to perform consistent monitoring, conduct routine testing of security systems and processes, and maintain a vulnerability management program to address any potential weaknesses promptly.

6. Maintain an Information Security Policy

Effectively communicate and document your company’s security processes for all stakeholders, including employees, management, and third-party vendors. Ensure everyone understands their role and responsibility in cybersecurity matters.

To help check your organization’s PCI DSS compliance, download your free detailed checklist to measure your efforts in meeting the goals and requirements.

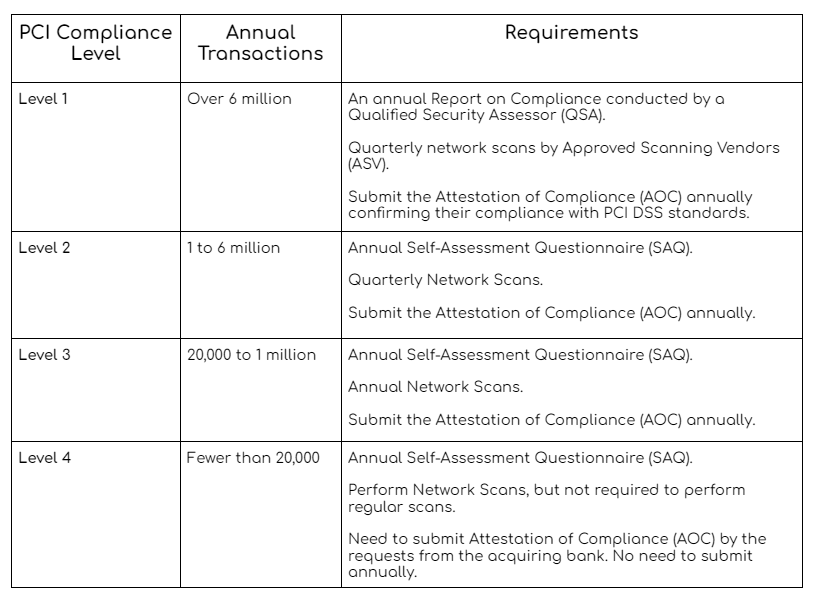

What are the PCI DSS compliance levels?

PCI compliance levels categorize businesses based on their annual transaction volume. The levels, ranging from 1 to 4, help tailor the specific requirements for each organization.

Here’s a breakdown:

How Stopping Website Spoofing Aids PCI DSS Compliance

Website spoofing is a deceptive phishing tactic where cybercriminals create fake websites mimicking legitimate ones. These replicas use similar domain names, logos, and designs to fool users into disclosing sensitive information like credit card details or login credentials. Preventing website spoofing is integral to PCI DSS compliance since fraudulent websites often trick users into entering sensitive information like credit card details.

By stopping website spoofing, businesses mitigate the risk of unauthorized transactions and align with PCI DSS Requirement 6, “emphasizing the need to maintain secure systems and applications.” Memcyo ensures that sensitive payment card information is only submitted to genuine, secure sites—upholding the data security standards required for PCI DSS compliance.

Memcyco’s anti-spoofing solution has advanced capabilities in detecting and preventing spoofed websites and ensures that businesses and their customers are protected from data loss, financial fraud, and other consequences.

It offers benefits such as:

- Preventing Spoofed Websites from Appearing in Search Results: Memcyco’s solution continuously monitors search engine results pages (SERPs), identifies spoofed websites, and prevents them from appearing in search results.

- Enhancing PCI DSS Compliance: Memcyco’s solution directly and indirectly meets PCI DSS requirements by preventing unauthorized access to personally identifiable information (PII).

- Protecting Brand Reputation: Memcyco protects a business’s brand reputation from spoofed website phishing attacks, ensuring customers encounter fewer fraudulent sites that could harm their trust in the brand.

Enhance PCI DSS Compliance with Memcyco

In the ever-evolving landscape of online transactions, it’s essential to ensure the security of sensitive payment card information. PCI DSS compliance is a solid foundation for safeguarding cardholder data, thwarting fraudulent activities, and maintaining customer trust.

Memcyco’s solution is a game-changer in the pursuit of PCI DSS compliance. Specializing in real-time protection against website spoofing and brandjacking, Memcyco offers a paradigm shift, ensuring immediate attack detection, comprehensive forensics, and innovative mitigation measures.

To experience Memcyco’s enhanced security, schedule a demo today.

![The PCI DSS Compliance Checklist for 2024 [XLS Download]](/wp-content/uploads/2023/12/The-PCI-DSS-Compliance-Checklist-for-2024-XLS-Download_Blog-page_1024x576-1.png)