Fraud isn’t just evolving- it’s exploding. What once involved old-fashioned pickpockets and stolen wallets is now a digital battlefield. And scammers are getting increasingly creative, too. From sophisticated cloned websites to deceptive phishing schemes, they are making it substantially harder for businesses to protect themselves and their customers.

In 2023 alone, criminals stole £1.17 billion through fraud in the UK, and banks’ security systems prevented fraud amounting to £1.25 billion more. Financial loss due to fraud can be significant, but this isn’t the only repercussion businesses must worry about.

From weakened customer trust to lost business and legal penalties, fraud can wreck a company’s bottom line, making fraud protection services a must-have.

What are Fraud Protection Services?

Fraud protection services are software solutions that detect, prevent, and mitigate various fraudulent activities, including payment fraud, identity theft, and account takeovers. These services often employ AI, Machine Learning (ML), and behavioral analytics to stay ahead of increasingly sophisticated fraud tactics.

ML models, for example, can learn from vast amounts of transaction data to identify patterns associated with fraudulent activity. As to behavioral analytics – these schemes can detect unusual behavior that may indicate fraud, even if the transaction appears legitimate.

These services are vital in sectors like finance, e-commerce, travel, logistics, and more, where digital transactions are businesses’ lifeblood.

Fraud Types You Need Protection From

Fraud takes various forms, each with unique challenges and risks. Understanding these types is crucial for selecting the proper protection services.

1. Identity Theft

Identity theft involves the unauthorized use of personal information for attacks such as account takeover (ATO) and new account fraud. For instance, ATO occurs when a fraudster accesses a legitimate user’s account with credentials harvested through phishing or data breaches and makes unauthorized transactions. New account fraud involves using stolen identities to open and exploit new accounts.

2. Credit Card Fraud

Credit card fraud involves the unauthorized use of credit card information for purchases or withdrawals. Standard methods include skimming devices, phishing schemes, and data breaches.

3. Online Shopping Fraud

Online shopping fraud involves tricking consumers into revealing personal information or purchasing on fake websites. Fraudsters use common techniques like phishing emails or social media impersonation to lure customers into these fake websites and convince them to buy counterfeit products.

4. Investment Fraud

Investment fraud includes deceptive practices like Ponzi schemes and pump-and-dump scams, which mislead investors with false promises of high returns. These schemes often use convincing marketing tactics to deceive less experienced investors.

5. Dating/Romance Scams

In dating and romance scams, fraudsters typically create fake profiles on dating sites and social media, often using stolen photos and fabricated personal stories to gain the victim’s trust. Once a connection is established, they may ask for money under various pretenses, such as medical emergencies or travel expenses.

6. Synthetic Identity Fraud

This is a growing type of fraud that creates new identities by combining real and fake information. For example, a fraudster might use a real social security number with a fake name. This fraud is complex to detect because the identity does not belong to a real person, evading traditional detection methods.

Why Do You Need Fraud Protection Services?

Fraud protection services are essential for businesses to prevent significant financial losses, protect customer records, and comply with stringent data protection regulations such as GDPR and CCPA. By detecting and stopping fraud before it happens, these services help secure revenue, particularly in sectors like e-commerce, where real-time detection can prevent costly chargebacks. Moreover, safeguarding sensitive customer information, such as credit card details and login credentials, not only helps avoid regulatory issues, but also strengthens customer trust.

In addition, implementing fraud protection measures reduces operational costs associated with customer reimbursement and incident resolution, by leading to fewer customer disputes. Lastly, businesses prioritizing fraud protection demonstrate a serious commitment to data governance, gaining a competitive edge as they foster long-term customer relationships.

Key Features to Look for in Fraud Protection Services

- Real-time detection is crucial for spotting and stopping fraud as it happens. Advanced algorithms monitor transactions instantly, flagging suspicious activities to prevent escalation and minimize impact.

- Behavioral biometrics analyze user behavior, such as typing speed and mouse movements, to spot anomalies. This method detects fraud even with correct login credentials, as behavioral patterns are challenging for fraudsters to mimic.

- Dynamic risk scoring evaluates transaction risk based on factors like amount and location. Higher-risk transactions are flagged for review, allowing businesses to optimize their risk assessment and address the most significant threats first.

- Comprehensive user activity monitoring tracks all user interactions with your systems, from logins to transactions. This broad view helps identify unusual behavior patterns that could indicate fraud, such as logins from unusual geographic locations and/or at unusual times.

- Adaptive authentication adjusts security measures based on transaction risk. Low-risk transactions may only require passwords, while high-risk ones may need multi-factor authentication or extra verification.

Top 10 Fraud Protection Services

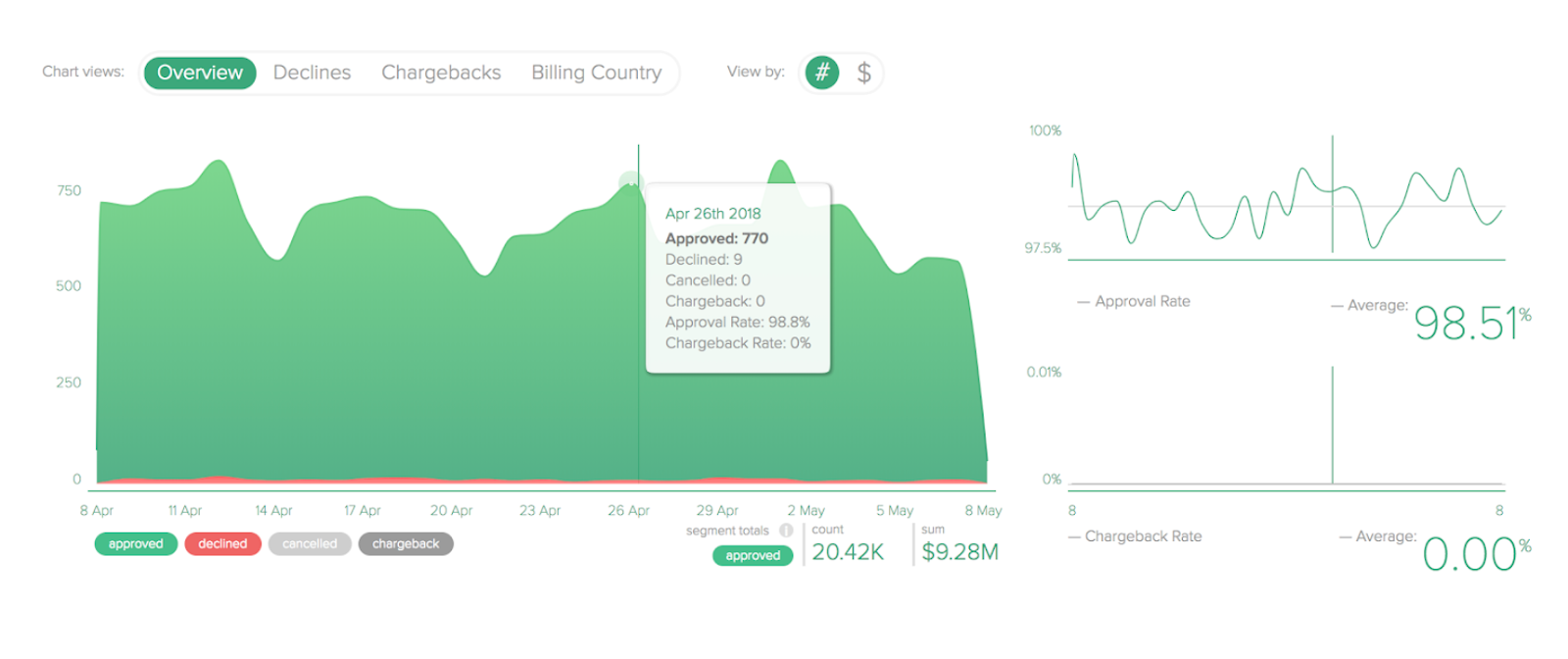

1. Riskified

Riskified puts AI and ML to solve challenges around real-time fraud prevention for e-commerce. This platform analyzes hundreds of data points per transaction, offering instant approve/decline decisions. Tailored to each merchant’s risk profile, it leverages behavioral analytics and cross-merchant insights to boost approval rates while minimizing fraud. It reduces false declines and gives merchants actionable sales and customer behavior data.

Best For:

Large e-commerce platforms seeking a scalable fraud prevention solution.

Customer Review:

“Excellent Machine Learning tool. The accuracy of the decisions is impeccable, and the dashboards and the tool are very user-friendly. Their chargeback guarantee model is revolutionary.”

2. Memcyco

Memcyco provides real-time visibility and control over digital impersonation fraud. Its unique nano-defender technology alerts businesses in real-time when their website has been cloned , allowing immediate response. The platform also delivers comprehensive behavioral analytics, helping companies track affected victims and fraudsters’ devices and locations to reduce attack impact. Your customers are also protected should they visit the cloned website even before it is taken down.

Best for:

Organizations looking to protect their digital assets from website impersonation and related fraud.

Customer review:

“Memcyco’s anti-impersonation technology allows 360 Security real-time detection, protection, and response for brand impersonation attacks. Companies can now get full attack visibility up front while protecting their customers from falling into phishing traps.”

3. NICE

NICE detects and prevents fraud, money laundering, and market abuse in real-time. It also offers modules for trade surveillance and know-your-customer processes, all unified under a central case management system. Its cloud-native infrastructure ensures scalability, while behavioral analytics and risk scoring enable dynamic assessments.

Best for:

Financial institutions and call centers that particularly need help with money laundering fraud.

Customer review:

“Power-packed application. The ease of setup and depth of information available on the platform.”

4. Forter

Forter provides real-time decisions on transactions to prevent fraud and maximize approval rates. By analyzing behavioral patterns, device data, and network intelligence across its global merchant network, Forter ensures accurate approve/decline outcomes. The platform protects against account takeovers, policy abuse, and return fraud.

Best for:

E-commerce businesses looking to reduce false positives.

Customer review:

“Good for business AND consumers. Forter reduces the overhead required to maintain traditional rules-based fraud platforms and manual human review.”

5. Kount

Kount, an Equifax company, uses ML and a vast data network to deliver real-time fraud detection across the customer journey. Its Identity Trust Global Network analyzes billions of interactions to assess fraud risk and build trust. The platform defends against account takeovers and bot attacks, while its adaptive AI reduces false positives and streamlines manual reviews.

Best for:

Businesses of all sizes seeking customizable fraud prevention solutions.

Customer review:

“The user interface is easy to navigate, and with the addition of 3rd party data providers, you have enhanced validation and ability to improve your decisions.”

6. ArkOwl

ArkOwl provides a data intelligence service specializing in email and phone number verification to prevent account takeover (ATO) and new account fraud. Their platform delivers detailed insights, such as creation date, social media presence, and associated domains, helping businesses assess risk during account creation and login. ArkOwl’s API enhances fraud prevention without adding friction, making it valuable for industries like e-commerce, fintech, and online gaming, where secure transactions are crucial.

Best for:

Businesses looking to enhance their user verification processes.

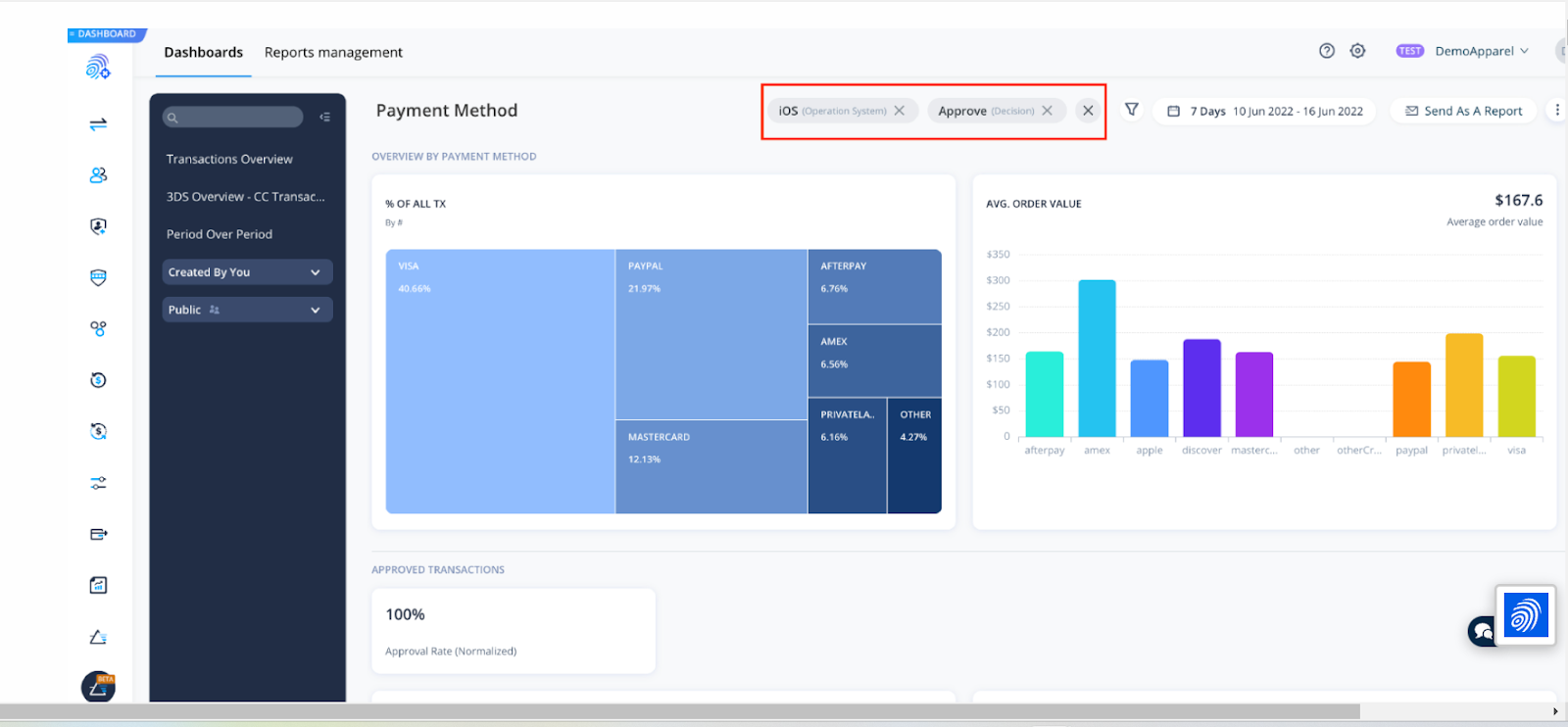

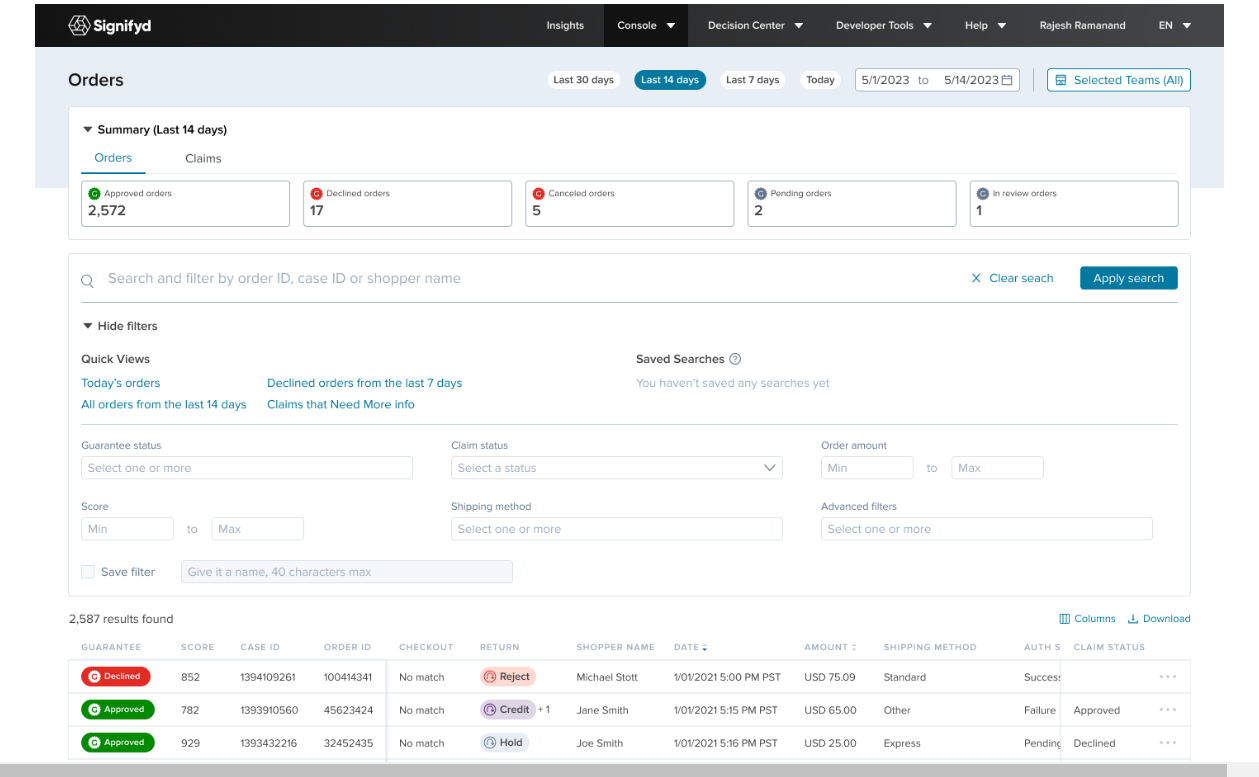

7. Signifyd

Signifyd provides a protection platform for e-commerce, fraud prevention, abuse prevention, and payment optimization. It analyzes transaction data from its extensive merchant network to make instant approve/decline decisions, with a financial guarantee against chargebacks. The platform also tackles policy abuse, account takeovers, and false declines, aiming to increase approval rates and reduce manual reviews. Signifyd integrates with platforms like Shopify, Magento, and BigCommerce, and supports major payment gateways.

Best for:

E-commerce businesses looking for guaranteed fraud protection.

Customer review:

“Open collaboration and dialogue relationship. Signifyd genuinely cares about its client relationship and wants to grow and evolve with their needs. Product development is nonstop, and the user experience is improving.”

8. ThreatMetrix

ThreatMetrix, a product from LexisNexis Risk Solutions, analyzes global device, location, behavior, and threat data to assess the risk of online transactions and account activities. By leveraging its global Digital Identity Network, ThreatMetrix helps businesses identify fraud attempts, prevent account takeovers, and reduce false positives, enabling secure transactions while minimizing friction for legitimate users.

Best for:

Large financial institutions requiring advanced fraud prevention tools.

Customer review:

“As someone who works in the fraud department, ThreatMetrix is my best friend. It identifies the probability of an order being fraud and gives a snapshot of all the orders going through with details unique to the order, like device ID, browser language, true IP, etc.”

9. Feedzai

Feedzai analyzes real-time transaction data to identify suspicious activity, with features like adaptive risk scoring, behavioral analytics, and automated decision-making. Feedzai’s platform integrates with banking and payment systems, providing scalable solutions for fraud detection, AML compliance, and customer verification.

Best for:

Financial institutions and payment processors.

Customer review:

“Detects fraud in time. I like it because it immediately identifies possible frauds that can affect my account, gives warning signs, and allows me to act quickly before cyber thieves do.”

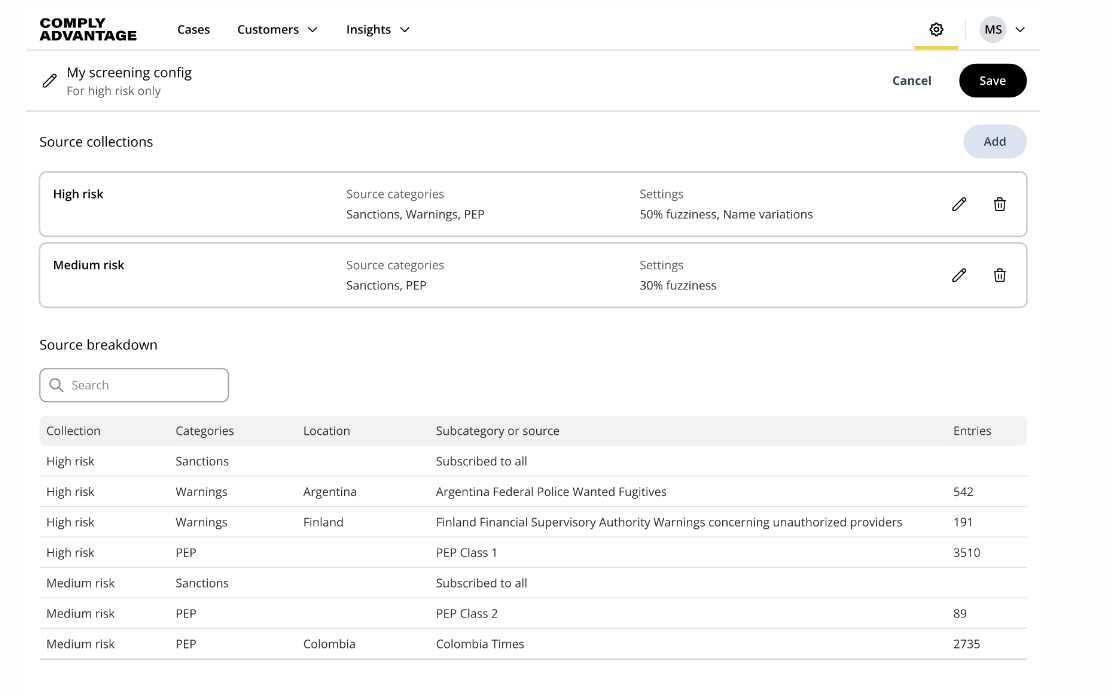

10. ComplyAdvantage

ComplyAdvantage provides a compliance and risk management platform specializing in anti-money laundering (AML) and counter-terrorist financing (CTF) solutions. Their platform uses AI and ML to deliver real-time screening, monitoring, and risk assessment of individuals and businesses. It offers enhanced due diligence, transaction monitoring, and adverse media screening to help organizations comply with regulatory requirements.

Best for:

Financial services firms looking to streamline compliance efforts.

Customer review:

“It’s a great tool designed to reduce AML and detect risk. The team is quick to respond, has a dedicated account manager, and can control different aspects of your searches and criteria. The system also can connect to Salesforce.”

Stay a Step Ahead of Fraud

Fraud protection services are vital for any business that values its reputation, customer trust, and financial security. As digital threats evolve, companies need robust solutions to stay ahead. Memcyco offers a unique approach to combating various types of fraud, such as account takeover (ATO) and brand impersonation. With real-time detection, protection and response capabilities, and by providing risk engine data unobtainable in the past, its digital risk protection (DRP) platform helps businesses safeguard their digital assets and customers.

Explore how Memcyco can bolster your defense against online fraud.