Today, fraud schemes don’t follow predictable patterns. Enterprises are up against AI-generated deepfake attacks, multi-stage social engineering, and impersonation scams that exploit gaps in traditional fraud prevention strategies. And they know it.

According to PwC, 59% of enterprises completed a fraud risk assessment in the 12 months prior to June 2024, showing they take fraud protection seriously. But beyond knowing your risks, there’s a need for better ways to tackle and mitigate them.

Dedicated Enterprise Fraud Management (EFM) solutions offer end-to-end visibility across your digital channels, helping you detect anomalies in real-time and dynamically adapt to evolving fraud tactics. The right mix of EFM solutions must be preventative, scalable, and adaptive.

What Are Enterprise Fraud Management (EFM) Solutions?

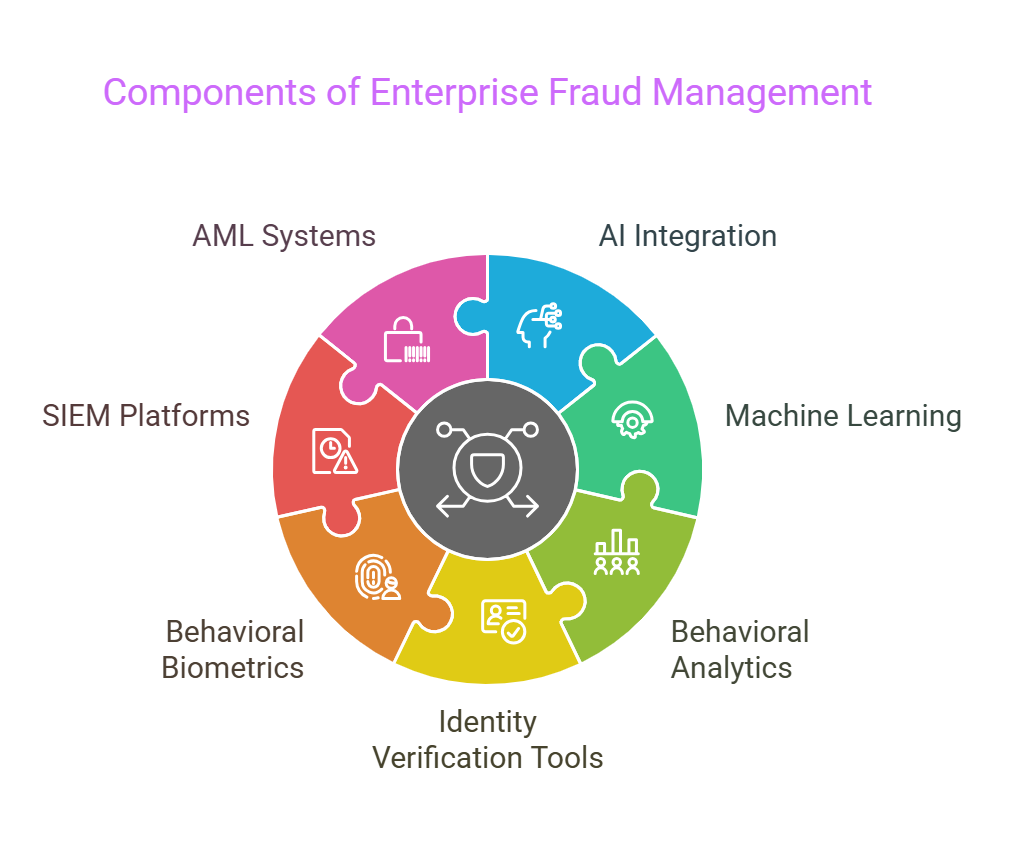

Enterprise Fraud Management (EFM) solutions help you identify, analyze, and mitigate fraud risks across multiple channels, systems, and attack vectors. These systems integrate AI, machine learning, and behavioral analytics to identify fraud patterns across transactions, user behavior, and digital interactions.

These solutions continuously monitor high-risk activities across digital touchpoints like banking apps, payment gateways, login forms, and customer support interactions. Many EFM solutions connect with identity verification tools, behavioral biometrics, SIEM platforms, and anti-money laundering (AML) systems to ensure fraud detection aligns with overall risk management strategies. They also typically use risk-scoring models to flag anything unusual.

EFM solutions are essential for any business that manages financial transactions and customer accounts or is subject to anti-fraud regulatory compliance requirements. So whether you’re at a bank detecting money laundering schemes, an e-commerce company preventing bonus abuse, or a fintech company stopping fake account registrations, you’ll want at least one dedicated EFM tool.

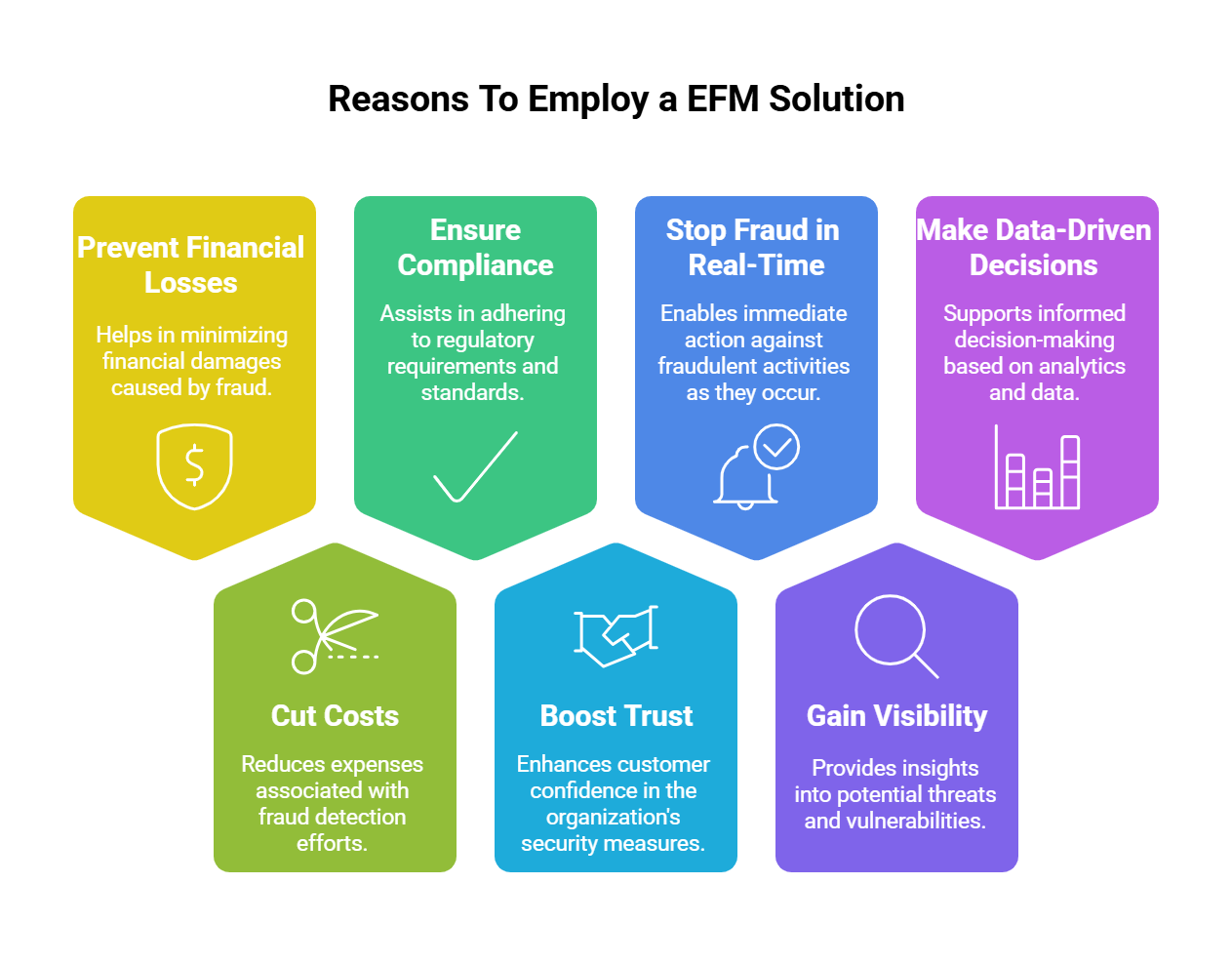

Why You Need An Enterprise Fraud Management (EFM) Solution

Manual fraud detection and fragmented security tools struggle to keep up with AI-driven fraud tactics, real-time deception, and multi-vector attacks. EFM solutions give you a centralized, automated, and intelligence-driven approach to catch fraud before your reputation suffers and your customers lose money. Benefits of these tools include:

- Increased efficiency in fraud detection and response: EFM platforms automate risk assessment, alert triaging, and fraud investigations, allowing your security and fraud teams to focus on high-risk cases instead of sifting through lots of false positives that waste their time and cause burnout.

- Faster recovery from fraud incidents: By integrating with SIEM and SOAR platforms, EFM tools enable automated fraud response actions. You can freeze accounts, block real-time transactions, or escalate cases to law enforcement.

- Better decision-making through data-driven insights: EFM platforms provide deep fraud intelligence by analyzing data from multiple sources to improve fraud prediction models, optimize security policies, and inform executive risk decisions. You also get visibility into trends, which helps you stay ahead of emerging threats.

Key Features to Look For in Enterprise Fraud Management (EFM) Solutions

Not all fraud management solutions work the same way to combat fraudsters. However, there are some key features to look out for in a high-performance EFM system.

1. Real-time detection and response

Real-time detection is a non-negotiable feature for any enterprise fraud management platform. An effective EFM solution needs to analyze transactions, login attempts, and account activities as they happen, whether using machine learning, anomaly detection algorithms, or some combination.

This matters because real-time detection can prevent fraudulent transactions rather than flagging them for review after they occur when the damage is done. It also helps you better cope with rapid, automated attacks like credential stuffing or session hijacking.

2. Cross-platform tracking

In many modern fraud scams, attackers exploit gaps between authentication methods, payment workflows, and customer interaction points. A good feature is the correlation of risk signals across multiple platforms to identify fraudulent behavior patterns.

For example, a fraudster might send a phishing email leading to a fake version of a banking website, tricking one of your customers into entering their credentials. With stolen login details, the attacker executes an account takeover via mobile login and then attempts high-value transactions via web banking. Correlating suspicious behaviors across multiple digital and physical touchpoints makes it harder for these fraud patterns to slip through your defenses.

3. Device fingerprinting

Fraudsters use tactics like emulated devices, virtual machines, and mobile malware to try and bypass fraud detection. Device fingerprinting is helpful because it creates a unique identifier based on users’ hardware, browser settings, installed fonts, and network signals. This makes it harder for fraudsters to mask their identities, run multi-account fraud, and take over unsuspecting users’ accounts using stolen credentials.

Top 7 Enterprise Fraud Management (EFM) Solutions

1. HUMAN Security

HUMAN Security specializes in bot detection to prevent automated attacks such as credential stuffing, fake account creation, and ad fraud. Its platform operates at the network and session levels and finds bot-driven anomalies through advanced fingerprinting and behavioral pattern analysis. The company’s Human Verification Engine cross-references thousands of telemetry signals in real time to identify and neutralize automated fraud before it reaches transaction-level defenses.

Best For:

Enterprises that need preemptive bot mitigation to combat large-scale, automated fraud attempts.

Cons:

Some users report complex setups, poor interface design, and ineffective blocking.

2. Memcyco

Memcyco fills a critical gap left by traditional EFM solutions by focusing on the pre-transaction signs of fraud in digital impersonation attacks. While most EFM systems focus on transaction-level anomalies, Memcyco detects and disrupts the digital impersonation threats and online scams that are common precursors to customer ATO and payment fraud.

One of Memcyco’s standout capabilities is decoy data. Even if customers access impersonating websites, Memcyco’s decoy data replaces user credentials and card data inputted by customers lured to fake login and payment forms. When threat actors try to use the decoy credentials or card data thinking they’re real, they’ll automatically reveal traceable device data while locking themselves out.

With an agentless deployment, Memcyco integrates seamlessly with existing fraud defenses without requiring customer downloads or actions of any kind. Memcyco customers can expect scalable, proactive protection from digital impersonation scams without disrupting their experience.

Best For:

Companies looking to strengthen their front-line fraud defenses against phishing and website impersonation before fraud escalates

Customer Review:

“Memcyco gives us pre-emptive foresight of ATOs in the making with real-time visibility into phishing attacks and brand scams before they hit our customers. Even if customers fall for scams, Memcyco dismantles card data and credential theft attempts at the moment of impact.

– Oren. K CEO

Cons:

Memcyco is best suited to in-house fraud and security teams, with no mobile app currently available, so may be less suited to sole traders without these dedicated functions”

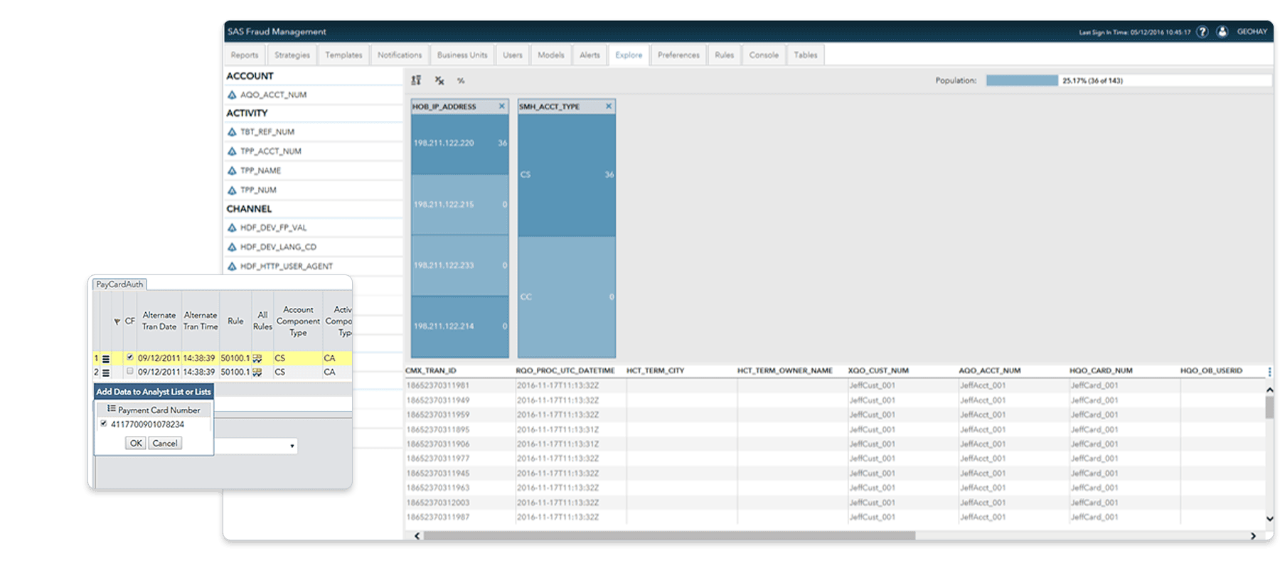

3. SAS

SAS Fraud Management deals with high-speed, high-volume transaction monitoring. This makes it useful for banks and payment providers that process millions of transactions daily. A real-time analytics engine applies adaptive machine learning models to assess payment behavior rapidly and find anomalies without disrupting legitimate transactions.

SAS stands out for its impressive data ingestion capabilities. The tool can pull info in from internal banking logs, external risk feeds, and cross-channel interactions to continuously refine identity threat detection and response techniques.

Best For:

Large financial institutions that require real-time transaction monitoring with high accuracy.

Cons:

Some users report that the tool is complicated to set up and understand and gathers a lot of irrelevant data.

4. Experian

Experian’s fraud prevention suite integrates identity verification, device intelligence, and risk-based authentication. The platform helps businesses prevent fraud at multiple touchpoints, from account opening to transaction approval. An interesting feature is the One Identity Trust Score, which dynamically adjusts fraud risk based on real-time identity signals from your users. This score includes consumer data points like login times, transaction behaviors, and navigation paths.

Best For:

Enterprises looking for strong identity intelligence to detect synthetic identities.

Cons:

Some users highlight a poor user interface in the tool.

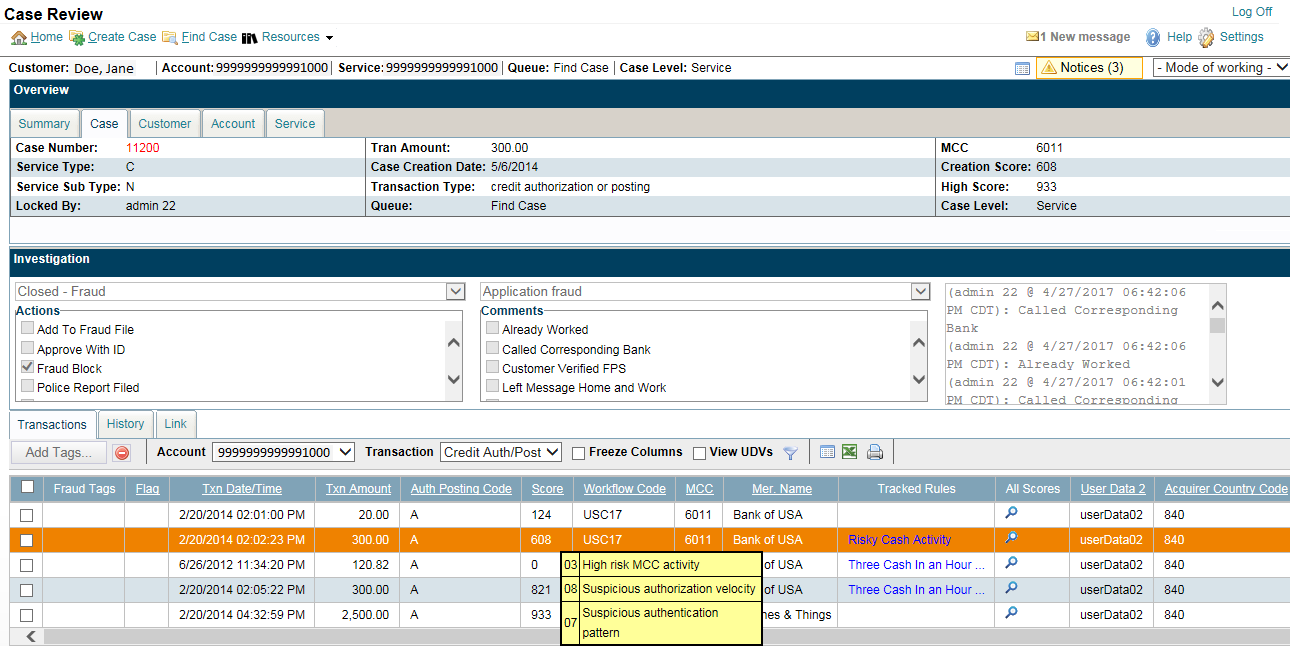

5. FICO Falcon

FICO Falcon is a neural network-based fraud detection engine trained on over 9,000 financial institutions’ transaction data. The system continuously refines fraud detection models based on real-world global fraud trends, so it’s effective at spotting payment fraud, credit card fraud, and unauthorized transfers. You can also use an adaptive authentication feature, which dynamically prompts users for extra verification when transactions show strong risk signals.

Best For:

Banks and payment processors that need highly trained, globally adaptive transaction fraud detection models.

Cons:

One user expressed frustration that the tool tags fraud on selected transactions in some accounts but fails to detect similar fraudulent transactions in other customers’ accounts.

6. NICE Actimize

NICE Actimize provides an AI-powered fraud orchestration platform that combines transaction monitoring, case management, and behavioral profiling in a single interface. Actimize’s cross-channel risk analytics engine is handy because it can detect linked fraud patterns across mobile banking, wire transfers, and card-not-present (CNP) transactions. A behavioral analytics engine learns your typical customer behaviors and flags unusual activity even when the transaction looks normal.

Best For:

Financial institutions that want cross-channel fraud detection with automated case management.

Cons:

One review reported that the tool is cumbersome to set up and runs slowly for end users.

7. Fraud.net

Fraud.net offers a cloud-native fraud detection platform that integrates big data analytics, machine learning, and collective intelligence to combat fraud across e-commerce and digital marketplaces. The platform’s engine scores transactions by combining IP reputation, device intelligence, and behavioral biometrics. In addition, Fraud.net incorporates cloud data security measures to ensure that all sensitive customer and transaction data remains protected.

Best For:

Mid-sized to large enterprises looking for a collaborative fraud intelligence network alongside traditional real-time fraud detection.

Cons:

There is a lack of customization and flexibility. Users report that they can’t amend or add new rules directly to the platform without contacting a Fraud.net rep.

Closing the Gaps in Enterprise Fraud Prevention

The difficulty with fraud in the digital world is that it’s no longer about stolen credit cards or fake identities. Fraud tactics have expanded to include multi-layered attacks that span phishing emails, digital impersonation, synthetic identities, and AI-driven deception. Fraudsters move between fake websites, compromised logins, and transaction manipulations to bypass detection.

Traditional Enterprise Fraud Management (EFM) solutions are essential, but without real-time visibility into the pre-transaction stage, you’re still playing defense after the damage has already begun. Fraud often starts well before any transaction occurs through tactics like phishing, brand impersonation, and website spoofing to trick your users outside your site or platform.

Memcyco disrupts fraudsters’ tactics like phishing and website impersonation at the source. The agentless platform instantly identifies cloned websites and fake login pages when they go live. Using a Red Alerts system, Memcyco warns your customers they’re visiting a fake version of your site before they type in sensitive info like card details or credentials.

Being agentless means Memcyco integrates seamlessly into your existing fraud management strategy without disrupting business operations. Combined with strong identity verification, behavioral analytics, and transaction monitoring, Memcyco adds an invaluable first line of defense to your fraud strategy. Get your demo today.