Risk management has always been a central part of business, especially for financial institutions. From bank loan underwriting to insurance premium calculations and payment risk assessment, comprehensive risk management methodologies are vital to any business that deals with high-trust user actions.

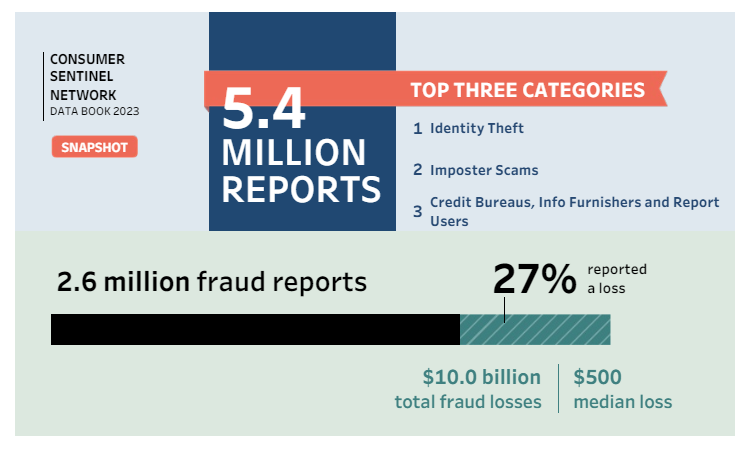

In particular, risk management is crucial to combating fraud – a huge global problem, the broad economic impact of which is clear. In 2023, the sum of reported losses to fraud was $10.0 billion in the United States alone.

At the core of fraud risk management lie complex statistical calculations that aim to assign a numerical value to the risk exposure associated with every high-trust transaction and activity. In most cases, these calculations hinge on risk engine software that adapts to the scope and realm of relevant financial fraud.

In recent years, risk engines have evolved to counter the increasingly complex and sophisticated techniques online criminals seek to defraud and exploit individuals and businesses. Before we discuss the challenges that led to this evolution in risk engine architecture, let’s delve into the inner workings of a fraud detection and prevention risk engine.

What is a risk engine and how does it work?

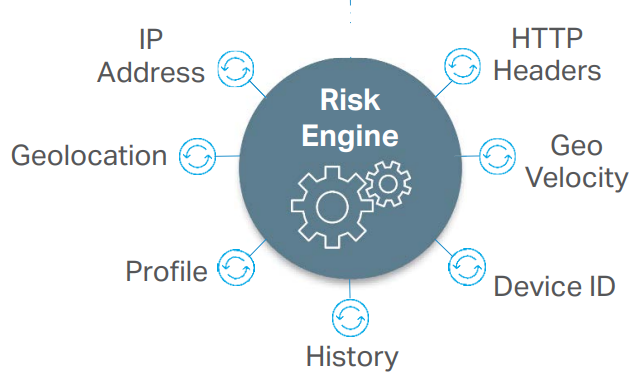

Risk engines are software tools that analyze user activities, especially financial transactions, to assess risk and assign a numeric score to each transaction. Then, the risk engine can approve or reject a transaction if it exceeds a certain predefined threshold.

Most traditional risk engines employ statistical rule-based models for risk scoring (like Decision Trees and Neural Networks) and ingest various data from different sources to assess the risk involved with every transaction. With online transactions, these sources include device fingerprinting, transaction amounts, negative data checks, geo-location info, third-party risk indicators, and chained linkages.

One interesting application of risk engines – in this case, outside the realm of finance and banking – is risk-based authentication (RBA). For example, to add a layer of security without over-encumbering the user experience, a risk engine can analyze login attempt metadata like the user’s location, IP address, device fingerprint, or uncharacteristic login patterns. Then, the risk engine can decide, based on pre-configured rules, whether the user needs to re-authenticate for security reasons or can be allowed instant passwordless access without additional actions.

In the era of contactless mini-transactions, comprehensive and practical risk engines are critical for detecting and preventing digital payment and e-banking fraud. Ideally, a fraud detection and prevention risk engine will consider various payment risk signals:

- Disposable email addresses

- Non-adherence with local or global financial sanctions

- Non-compliance with FATF regulations

- Possible indication for purchase of banned or counterfeit products

- Transaction frequencies

- Potential chargeback fraud indicators

- Account takeover (ATO) indicators

The Challenges With Statistical Risk Engines for Fraud Detection and Prevention

Rule-based statistical risk engines have existed for quite some time—since before the dawn of online payment fraud. Most financial institutions or payment processors employ at least one type of fraud risk engine, be it an internally developed fraud detection and risk management system or an external “black box” risk engine service.

However, with the rate at which malefactors adopt generative AI and other advanced techniques to circumvent rule-based fraud risk engines, transaction-centric statistical risk engines simply do not provide adequate coverage. Many challenges are associated with the long-term dependence on rule-based risk engines for fraud detection and prevention.

Maintenance, overhead, and cost of ownership

Your typical rule-based risk engine requires quite a bit of maintenance. Its end users (fraud and risk analysts) need to constantly adjust its functionality, which includes expanding rulesets, removing old irrelevant rules, integrating new data sources, etc. Sometimes, software engineers need to be involved in that activity as well.

Trying to keep up with the shifting threat landscape through manual creation, maintenance, and administration of rules for your risk engine is bound to require hours of effort.

Another unexpected cost of running your risk engine may arise from the computing resources it consumes. More rules mean more resources, which not only raise your cloud vendor bills (like AWS Lambda, which scales on demand) but may also impact the performance of your fraud detection applications and, as a result, your customer experience.

Poor performance

Complex rulesets, as part of a risk engine, require large datasets to be ingested by the engine to assess risk. When so much data is passed into the risk engine, the application will send several synchronous requests to various APIs, including internal data sources and third-party resources. It results in poor performance and increased latency, leading to flawed and incomplete assessments. How? Because some rules may get skipped if their execution exceeds the acceptable wait time.

False positives and false negatives

Even if you ignore the speed at which malefactors find ways to sneak around rule-based risk engine decision-making, there’s the issue of model accuracy. Regardless of the type or number of statistical models you integrate into your fraud detection risk engine stack, they will continue to be limited to operation in a pattern-based process. This, in turn, is bound to generate a high rate of false positives and negatives – impacting your financial metrics, as well as your customer experience.

Reactive approach

Rule-based risk engines, however complex and well-maintained, are reactive by design. They respond to threats as they manifest themselves rather than alert your teams in real-time to insights that arise from collected evidence. They lack visibility and context, such as user pre-login activity or behaviors indicative of a website cloning attempt as part of a more extensive digital impersonation campaign. In addition, they are limited by historical fraud tactics as their learning platform to identify fraud while sometimes missing actual indicators and signs of a new type of fraud as they appear.

Proactive anticipation, quick identification, and “connecting the dots” are all vital to protecting your systems in a dynamic fraud landscape. Traditional rule-based risk engines might fail to deliver these factors.

“Say hi to our AI”: The Smart Risk Engine You May Be Missing.

AI/ML technologies armed the bad and good guys in the digital fraud battleground with a powerful weapon for offense and defense. Unlike static, rule-based fraud prevention engines, AI/ML models can ingest vast amounts of data to provide context and discover previously undetected patterns that may indicate new fraud tactics. They won’t get slowed down by vast amounts of data as it grows. The more data – the better your ML will be trained.

The overhead reduction that AI/ML-enhanced risk engines introduce is as important as scalability and performance. They eliminate the need to invest time (and money) in manual rule updates and transform your risk management lifecycle into one where machine learning algorithms do the heavy lifting.

AI/ML alone is not a magic wand that can solve all your fraud trouble. Instead, it can augment your risk engines to make smarter decisions faster, while combining more data sources (like behavioral biometrics and real-time threat intelligence) in contextual fraud signal scoring and thresholding.

What’s Next for Your Fraud Prevention Risk Engine

Fraud detection, prevention, and expedited mitigation are essential to maintaining the critical driver of business – trust. On the one hand, clients expect lightning-fast and frictionless user experience. On the other hand, you may be working with outdated risk engines that require extensive and expensive management and upkeep to remain even somewhat relevant in your battle against fraud, which can easily lead to financial losses and poor customer experience.

The solution to this predicament may sound simple, but it entails a paradigm shift that puts the customer at the center of everything – including fraud prevention.

What does this look like? The answer is a proactive approach that balances user experience with innovative AI/ML-enhanced risk management solutions that feature real-time monitoring, risk-based authentication methods, and advanced tools that help foster confidence in your users and clients.

When enhancing the overall security posture of your online assets, Memcyco offers a multilayered website and brand impersonation suite that employs proprietary AI/ML algorithms to give you unprecedented and contextualized real-time insights into potential digital impersonation threats. In particular, Memcyco’s platform connects to your risk engine and provides real-time information about attacks, attackers, and each victim. This additional data, which was not available before, allows you to improve risk engine predictions significantly.

Book a demo today and learn how Memcyco can help upgrade your risk engine and protect you and your customers from impersonation-related fraud.