Best-selling writer Maria Konnikova once wrote, “Fraud thrives in moments of great social change and transition.” These words ring truer than ever as additional aspects of business and everyday life move swiftly online. Whether you think about eCommerce, remote work, online banking, or digital government services, the opportunities for fraudsters continue to multiply.

The online world currently creates such a fertile ground for fraudulent activity that U.S. consumers reported losing more than $10 billion USD to fraud in 2023—a 14 percent increase over 2022. Companies must remain vigilant for fraud to protect themselves and their valued customers.

Fraud monitoring is a powerful way to get this protection—here’s what you need to know about it and how to tell if your company needs it.

What is fraud monitoring, and why do you need it now?

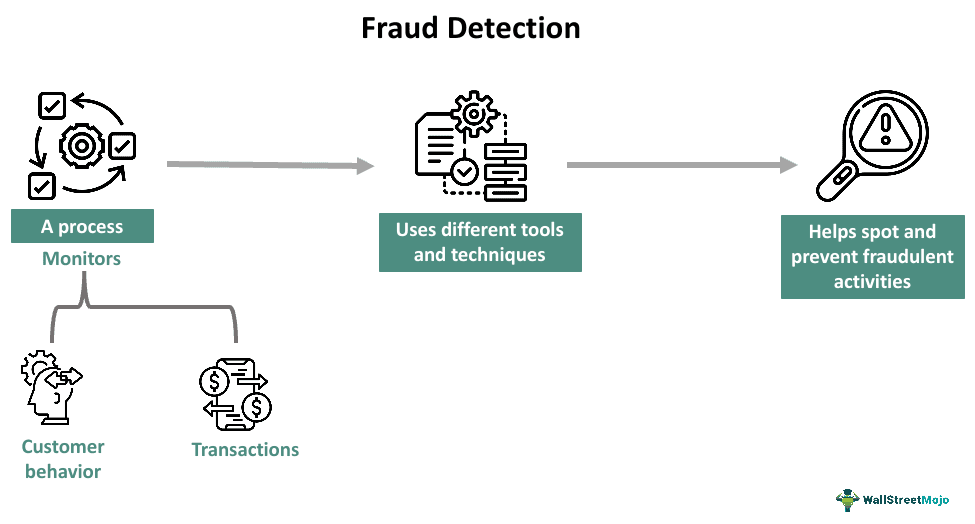

Fraud monitoring uses analytical methods and algorithms to quickly scrutinize digital transactions, behaviors, and activities to identify and mitigate digital fraud. These solutions help stop issues like account takeover attacks, identity theft, fraudulent payments, and even insider fraud.

The need to specifically monitor for fraud becomes more pronounced due to the sophistication, volume, and variety of tactics that threat actors use in today’s digital landscape. Manual monitoring or traditional fraud detection methods are no longer feasible at the scale of transactions and interactions handled digitally by many businesses.

To combat these increasingly sophisticated tactics, fraud monitoring solutions leverage advanced analytics and machine learning. It allows them to adapt and evolve, discovering patterns that might otherwise go unnoticed.

Consider the growing issue of synthetic identity fraud, which involves blending real and fake information to create new identities and open fraudulent accounts. The subtlety of these more advanced fraud activities, combined with the vast amounts of data to analyze and the need for rapid detection, makes manual monitoring or simple rule-based systems unfit for their purpose.

What are the benefits of fraud monitoring?

Fraud monitoring offers businesses valuable benefits, including:

Revenue Protection

Fraud monitoring plays a vital role in protecting your company’s revenue. By proactively detecting and preventing fraudulent transactions, you demonstrate a commitment to safeguarding customer data and assets. This builds customer trust and loyalty, and supports long-term revenue stability by protecting against losses and unnecessary expenses due to fraud.

Efficiency

Whether your company has a dedicated fraud team or a security team that monitors suspicious activity, automating fraud detection significantly improves efficiency. Teams spend less time on investigations, and dedicated tools provide the speed and scalability to detect and respond to these threats effectively.

Regulatory Compliance

Many industries face strict regulatory requirements to combat fraud and protect consumer data. Fraud monitoring systems help organizations comply with these often complex regulations and avoid the hefty fines and legal penalties that frequently occur with non-compliance.

Adaptability to New Threats

Fraud monitoring systems using machine learning and artificial intelligence can adapt to new and evolving fraud patterns. This adaptability helps to make sure that you can stay one step ahead of fraudsters, even as their tactics change.

Ensuring Customer Trust

Monitoring for fraud assures customers that you take security seriously, so they’re more likely to trust your business for future transactions. It safeguards their accounts and financial assets while enhancing their overall business experience with your company.

Brand Protection

Fraud monitoring tools are essential for identifying and mitigating cases where malicious actors exploit your company’s brand in phishing scams using malicious spoofed websites or emails or unauthorized use of your brand’s name and logo. This type of fraud can significantly damage your brand reputation if disgruntled consumers start defaming your company on social media, for example.

What are the types of fraud monitoring?

Fraud monitoring types include:

- Transaction Analysis: Monitors transactions for suspicious activity, like large purchases or unusual spending patterns.

- Behavioral Analytics: Analyzes user behavior to identify deviations from normal activity potentially indicating account takeover, such as an unusual time zone.

- Identity Verification: Ensures the user’s claimed identity matches their genuine one to prevent fraudulent access or account creation.

- Risk Scoring: Assigns a risk level to transactions based on various factors, helping prioritize potential fraud.

- Device Fingerprinting: Creates a unique identifier for a user’s device to detect unauthorized access from unknown devices.

- Cross-Channel Surveillance: Monitors activity across different channels (e.g., mobile app, website) to identify inconsistencies.

- Geolocation Analysis: Analyzes user location data to detect transactions originating from unexpected places.

- Communication Screening: Monitors communication for suspicious messages or attempts to manipulate users.

How does fraud monitoring work?

Step #1: Data Gathering

Fraud monitoring systems gather data from various sources, including transaction records, user interaction logs, application usage patterns, and communication channels. This data can also come from external sources like credit reporting agencies and public databases.

Step #2: Analysis

The tools generally use analytical techniques, such as machine learning algorithms and statistical models, to probe the collected data and identify patterns and behaviors consistent with known fraud scenarios. This analysis includes looking for anomalies or deviations from standard patterns that could indicate fraudulent activity.

Step #3: Risk Scoring

Transactions or activities get assigned a risk score based on the likelihood of fraud. This scoring is dynamic and often uses a range of indicators, including the size and frequency of transactions, geographic location, and the device or network used.

Step #4: Alerts and Investigation

When the system identifies potential fraud, it generates alerts and sends them to relevant personnel. Systems often prioritize these alerts based on the severity and likelihood of the scam. After receiving an alert, the fraud team will review suspicious activity to verify the threat. This investigation might involve more data gathering, contacting the customer for verification, or cross-referencing against known fraud patterns.

5 Ways to Tell If You Need Fraud Monitoring

1. You Lack In-House Fraud Expertise

Running a successful business requires focusing on your core competencies. For many companies, fraud mitigation isn’t one of them.

Fraud monitoring solutions offer the benefits of pre-built expertise and constantly updated knowledge about the latest threats. This expertise helps ensure your company stays ahead of the curve without needing a dedicated fraud team.

2. Your Business Is in Ecommerce

Certain sectors are more prone to fraud due to the value of the data they handle or the financial transactions they facilitate. Ecommerce provides multiple avenues for fraud, from the creation of fake websites to the unauthorized use of stolen card details.

High transaction volumes and personal data collection make eCommerce companies vulnerable to various fraud types, from customer account takeovers to website spoofing fraud, where malicious actors create copies of legitimate sites and try to lure customers onto a fake website instead of the authentic version.

3. Increased Customer Complaints

A growing number of customer complaints about account access issues, unauthorized transactions, or unrecognized account changes indicates high levels of fraudulent activity that need more advanced and dedicated monitoring.

These complaints might relate to customer account takeover, identity theft, or credit card fraud. They reflect the aftermath of fraudsters successfully breaching your customers’ accounts or using stolen financial information.

4. You Accept Payments from Diverse Methods and Channels

The adoption of various payment methods (credit cards, digital wallets, cryptocurrencies) and channels (online, mobile apps) enhances customer convenience but also broadens the attack surface for fraudsters.

If your business supports multiple payment avenues, the complexity of securing each one against fraud escalates. Fraud monitoring that covers all these vectors can provide a cohesive defense mechanism, ensuring that vulnerabilities in one do not compromise overall security.

5. High-value Assets or Transactions

If your business deals with high-value assets or transactions, it’s automatically an attractive target for sophisticated fraud schemes that aim to divert large sums of money or valuable data.

Common scams you might face include business email compromise, wire transfer fraud, and investment fraud. Because high-value transactions can yield significant returns for fraudsters, they’re happy to run complex schemes and see if they pay off.

Reduce Your Fraud Risk with Memcyco

Few digital businesses today don’t need dedicated fraud monitoring solutions. However, combating specific fraudulent activities like the ones based on website impersonation requires a unique approach with advanced capabilities.

Infused with AI, Memcyco’s real-time digital risk protection solutions grant businesses complete visibility and control of website spoofing attacks before money theft, data breaches, and ransomware occur. Memcyco’s unique ‘nano defender’ technology detects, protects, and responds to attacks as they unfold.

Uniquely designed to protect your business from the dangers of spoofed websites and associated fraud, Memcyco protects your business and customers from fake website fraudsters while providing you with full visibility into the attack, attacker, and each individual victim.

A significant additional benefit is your ability to connect Memcyco’s findings to your risk engine to improve your predictions in the future.

Contact Memcyco today to learn more.